Scam Resource Center

When it comes to dealing with scammers, knowledge is power.

Important Scam Alert—Updated as of 2/20/2026

We are receiving increased reports of imposters who are pretending to be employees of Credit Union ONE. Additionally, sophisticated scammers can mask their phone numbers to show "Credit Union ONE" on caller IDs, despite their numbers not being affiliated with us in any way.

Scammers may also have pieces of real information at their disposal, such as segments of a debit or credit card number. It is important to remember, Credit Union ONE will never initiate contact with you to ask for sensitive information, such as an online banking login, card number, or one-time passcodes. If you receive a suspicious message or phone call, do not respond. Hang up immediately and contact us directly instead.

Stay up to date on the latest security news:

Learn about common scams.Awareness is key. Know the signs and recognize the red flags.

A gift card scam is a type of fraud where scammers trick people into buying gift cards and then persuade or coerce them into sharing the card numbers and PINs.

Once the scammers have these details, they quickly drain the funds, leaving the victim with a worthless gift card that they spent their real money on. Common tactics include impersonating authority figures (often government agencies and utility companies), claiming urgent situations, or selling fake or already-used cards online.

Gift cards are favored by scammers because they are nearly untraceable and funds are hard to recover once spent. Credit Union ONE will never ask you to purchase a gift card under any circumstance.

For additional information regarding gift card scams, please visit the Federal Trade Commission (FTC) consumer advocacy website.

These messages often impersonate trusted organizations, such as banks, delivery services, or government agencies, and use urgent or enticing language to manipulate victims into acting quickly. The ultimate goal is to steal sensitive data, commit identity theft, or defraud individuals and businesses.

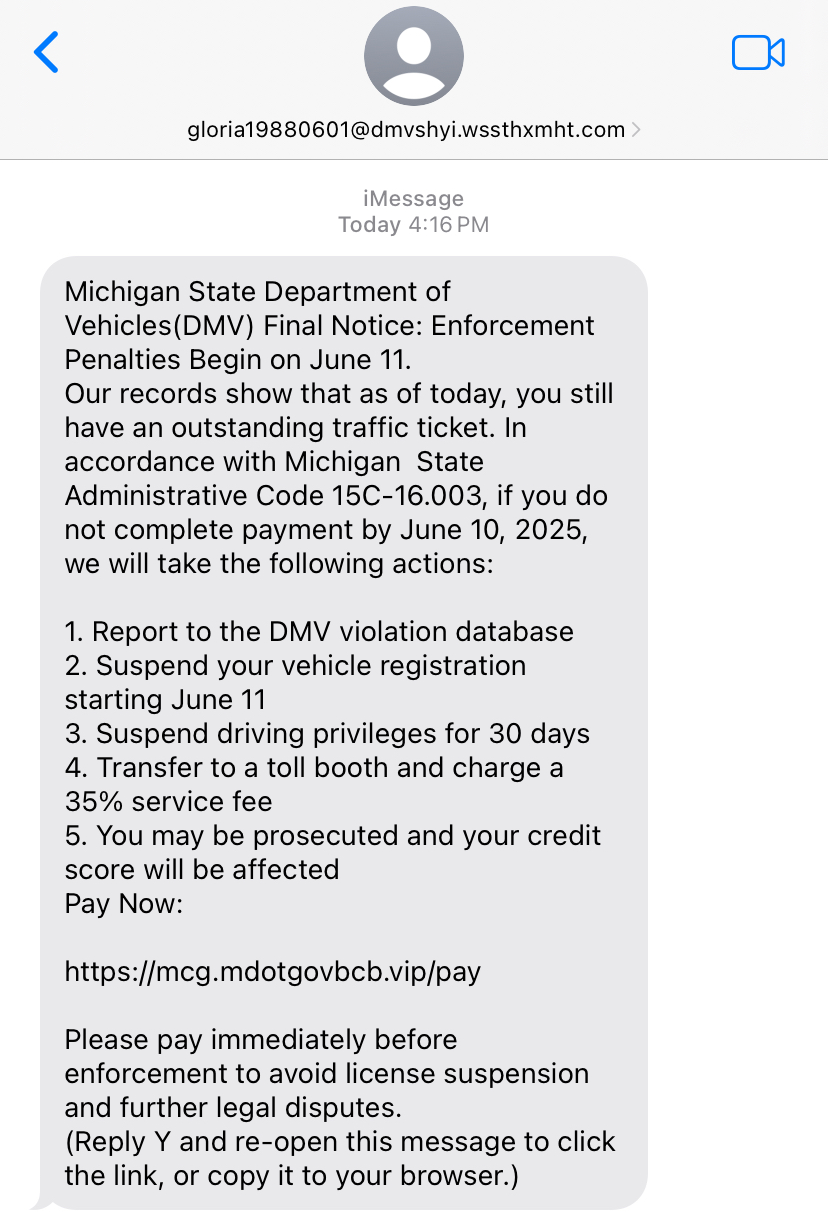

In this example, we see scammers are attempting to impersonate the State of Michigan:

Note a few things:

- The sender is a garbled string of letters and numbers from an incoherent website.

- The State of Michigan doesn't have a DMV.

- The State of Michigan doesn't have any toll roads.

For more information, please visit the Federal Communications Commission (FCC) website.

Phishing is a cybercrime technique where attackers impersonate legitimate organizations or individuals—often via email, websites, or messaging platforms—to deceive people into revealing sensitive information such as passwords, credit card numbers, or Social Security numbers.

These messages typically use urgent or alarming language to prompt quick action, like clicking malicious links or downloading infected attachments. The stolen information is then used for identity theft, financial fraud, or further cyberattacks.

Both the Federal Trade Commission (FTC) and Microsoft have resources available to learn more about phishing attacks.

Do you feel like you've been receiving an increasing amount of spam voice calls these days? You're not alone.

Vishing, short for "voice phishing," is a scam where fraudsters use phone calls or voice messages to impersonate legitimate organizations, such as banks, government agencies, or tech support. Then, they trick their victims into revealing sensitive information like account numbers, passwords, or Social Security numbers.

Vishing calls often use urgent or alarming language, spoofed caller IDs, and convincing scripts to pressure people into acting quickly and divulging confidential details.

If you receive a call from someone claiming to be from Credit Union ONE, do not provide them with any information. Instead, hang up, navigate directly to cuone.org, and call the official number listed there.

To learn more about vishing and spoofing, please see the resources provided by both the Federal Trade Commission (FTC) and the Federal Communications Commission (FCC).

Skimming is a type of scam where criminals use a small device called a skimmer to illegally capture data from the magnetic stripe of credit or debit cards during legitimate transactions.

These devices are often secretly installed on ATMs, gas pumps, or point-of-sale terminals.

Once the card data is stolen, scammers can clone the card or use the information for unauthorized purchases and identity theft. Skimming is especially dangerous because it’s often undetectable by the cardholder at the time of the transaction.

For more information regarding Skimming please visit the Better Business Bureau (BBB) website.

These scammers often use threats of arrest, fines, or legal action, and may spoof caller IDs or send official-looking documents to appear legitimate.

For more information regarding these scams, please visit the Internal Revenue Service (IRS) website. To report a scam please visit the Federal Trade Commission (FTC) fraud website.

These counterfeit websites often use similar logos, layouts, and web addresses (URLs) that are just slightly altered from the real site. The stolen information is then used for identity theft, financial fraud, or other cyber crimes.

For more information on website spoofing, please visit the State of Michigan's Consumer Protection website.

Additional Resources